Colin Gillis has twenty years of experience in the multifamily industry. As Chief Investment Officer for Passco Companies, Mr. Gillis is responsible for directing the firm’s nationwide multifamily acquisition efforts. During his ten years with Passco, Mr. Gillis has acquired nearly 17,000 units across 55 transactions in eleven states for a total consideration in excess of $3.7 billion.

Prior to joining Passco, Mr. Gillis served as Senior Acquisitions Associate for the Atlanta office of Los Angeles-based JRK Investors, as well as Senior Acquisitions Associate for Atlanta-based The Lane Company. In both of these roles Mr. Gillis was responsible for sourcing acquisitions for investments in the Southeast U.S.

We discuss where we’re investing today, the realities of the current multifamily market, and what we expect as supply pressures ease and fundamentals rebalance.

Listen to the Interview below

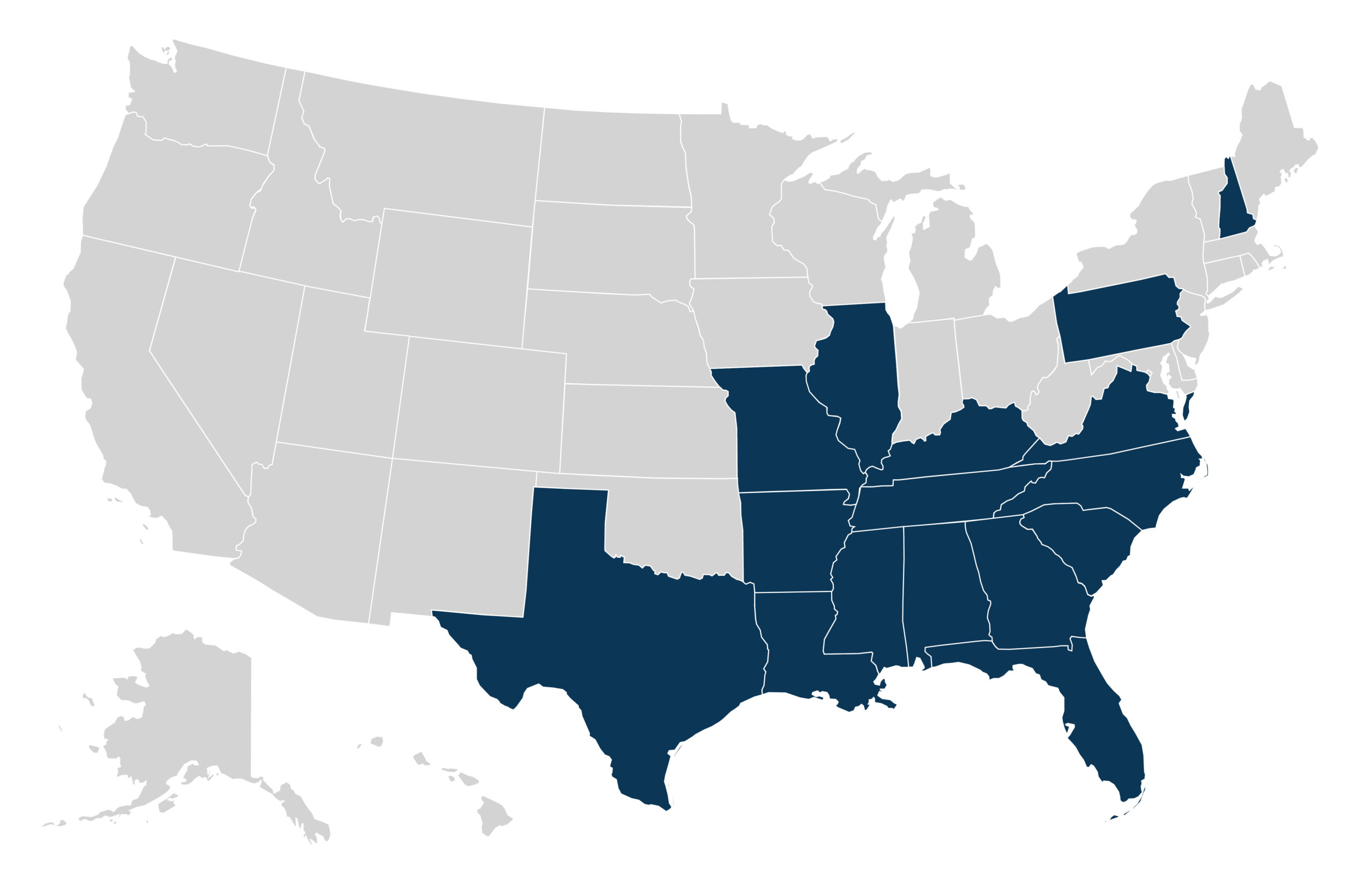

Multifamily Portfolio

53 Properties; 14,600 Apartment Units;

Operating in 17 States

Passco’s Target Acquisitions

- Size: $40MM-$125MM

- Target Markets: Willing to consider most markets nationally if there is a story, with few exceptions

- Holding period: 6-10 years

- Leverage / Debt: 55-65% Loaded LTV

- Y1 Cap rates: 5.35 – 6.50%

- Yields: 4.25% – 4.50%

For Broker Dealer use only